The major external sources of finance

Ordinary shareholders

Also known as Common stockholders.

Receive a dividend only if there are remaining

profits after preference shareholders and lenders have received their dividend

or interest payments.

Have limited potential loss liability but

unlimited potential returns.

Control the business through their voting rights

It may be possible for the business to avoid

paying a dividend, but it is not usually possible to avoid interest payments.

There is typically contractual obligation on the business to pay

interests.

The business does not obtain any tax relief on

dividends paid to shareholders, but interest payments on borrowings are tax

deductible from profit for corporation tax purposes.

Preference shareholders

Also known as preferred stockholders.

Have a lower level of risk than ordinary/common

shareholders.

Have priority over ordinary/common shareholders

in receiving dividends

Do not usually have voting rights

Dividends paid to preference/preferred shareholders, like those paid to

ordinary/common shareholders, are not allowable against taxable profits,

whereas interests payments on loans are allowable expense.

Types of loan capital

The risk/return characteristics of long-term capital

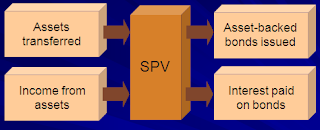

The securitisation process

Securitisation involves bundling together

illiquid financial or physical assets of the same type in order to provide

backing for an issue of bonds.

Securitisation involves bundling together

illiquid financial or physical assets of the same type in order to provide

backing for an issue of bonds.

Has spread beyond the banking industry and has

now become an important source of finance for businesses in a wide range of

industries.

Long-term versus short-term funding

Short-term and long-term financing requirements

Major internal sources of finance

Pecking order theory and long-term financing

Hello, an amazing Information dude. Thanks for sharing this nice information with us. Deductible Payments

ReplyDelete